As employer NIC contributions rise again this week, UK hospitality businesses are left wondering: how much more can we absorb?

While headlines focus on inflation and economic recovery, the day-to-day reality for hospitality operators is an ongoing squeeze that’s becoming unsustainable. This isn’t just about payroll—it’s about a broader system that places a disproportionate financial burden on one of the UK’s most vital and culturally significant industries.

Taxed to the Hilt: The UK vs Europe

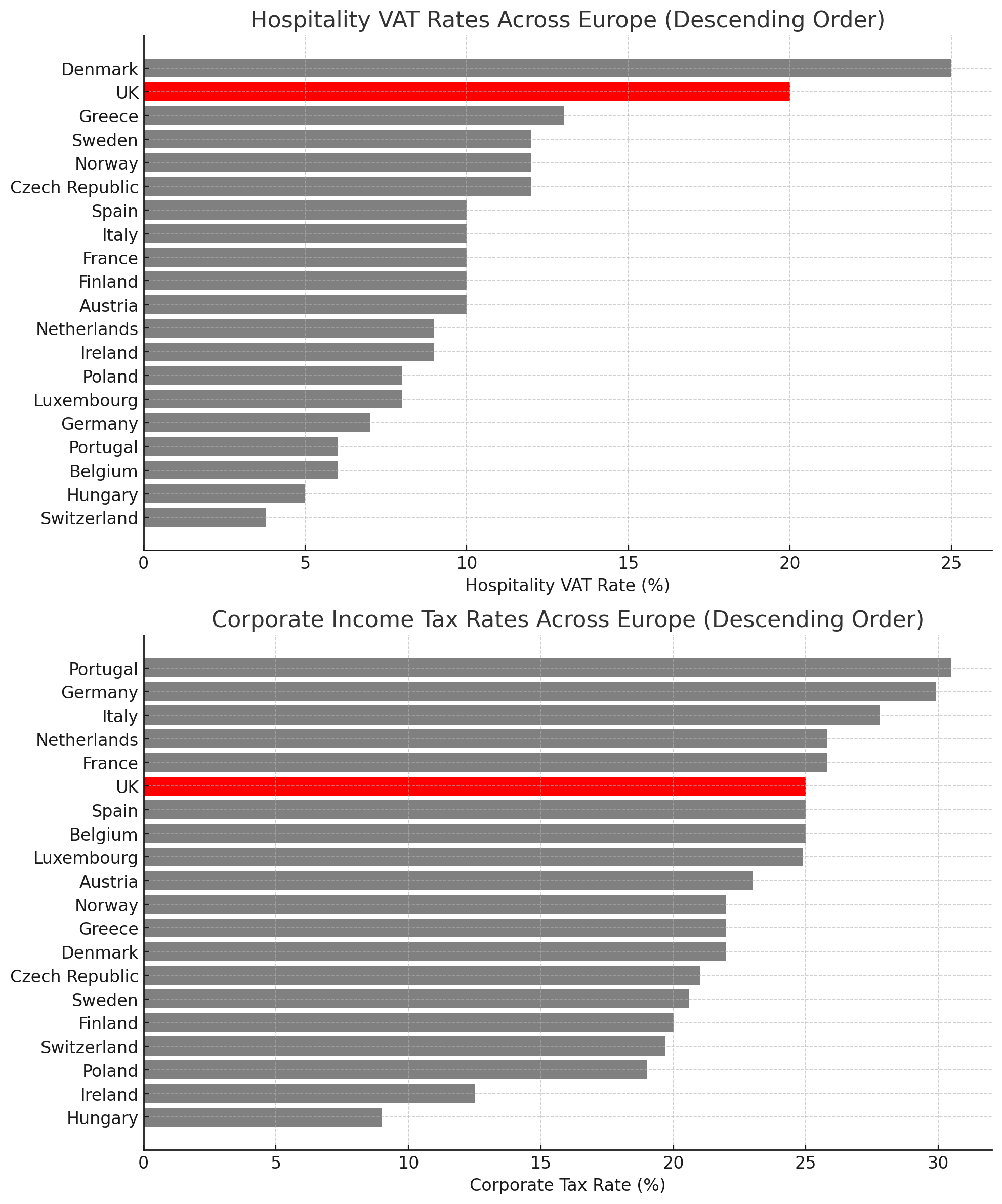

To understand how out of step we are, we compared the UK’s hospitality VAT and corporation tax rates with those across 19 other European countries. The results speak for themselves.

The UK sits close to the top of the table in both categories:

- VAT on hospitality in the UK is 20% — more than double that of countries like Germany (7%) or Belgium (6%).

- Corporation tax is 25% — higher than Ireland (12.5%), Hungary (9%), and even our own recent past.

Across much of Europe, hospitality is treated as a profession to support — a key part of national identity and economic recovery. It receives reduced VAT rates, targeted reliefs, and is often celebrated as a meaningful career path.

In the UK? It’s treated like a financial punchbag.

The Cost of Neglect

This isn’t just about taxes and margins. It’s about values. It’s about whether we see hospitality as a sector worth investing in — or just one to draw revenue from.

The result of our current approach?

- Talent shortages, as wages can’t keep pace with rising employer costs.

- Underinvestment in training, innovation, and guest experience.

- Business closures in high streets and communities where hospitality is the social glue.

A Call for Respect, Not Relief

This is not a plea for handouts. It’s a call for parity.

Parity with our European neighbours who see hospitality not as a luxury, but as a pillar of their economy. Parity in policy that acknowledges the sector’s role in job creation, tourism, and social wellbeing.

If we want to continue attracting international travellers, inspiring local talent, and leading the world in service — we need to start treating hospitality with the respect it deserves.

It’s time for a bold, joined-up strategy. One that aligns tax policy with sector ambition. One that sees hospitality as more than just a revenue stream.

Because right now, the numbers show what the sentiment has long confirmed:

Support for hospitality is long overdue.